In December 2015, FECO publicly displayed the 2016 list of put-on-file HCFCs

distributors, according to which the number of the distributors diminished

compared with that in 2015. This reflected that with China's continuous

elimination of HCFCs production and consumption, relevant market participants

have sped up their pace to withdraw from the market or change their products.

On 4 Dec., 2015, the Foreign Economic Cooperation Office, Ministry of

Environmental Protection (FECO) unveiled the 2016 list of put-on-file

hydrochloroflurocarbons (HCFCs) distributors.

Accordingly, 83 domestic distributors (vs. 88 in 2015) submitted their sales

related materials to FECO. Of this, 25 distributors came from Zhejiang

Province, 14 from Guangdong Province, 10 from Jiangsu Province, 7 from Shandong

Province, 3 from Liaoning Province, 10 from Shanghai, 4 from Beijing, 3 from

Tianjin, 2 from Jiangxi Province and Chongqing Municipality respectively, and 1

from Hebei, Anhui and Sichuan provinces respectively.

According to CCM research, relevant market participants has sped up their pace

to withdraw or change their products, as China is continuously eliminating

HCFCs production and consumption.

To be specific, 2013-2015 is the first stage that HCFCs was replaced in China's

refrigeration & air conditioner industry. As it will be the second stage from

2016, relevant production and consumption will be eliminated even faster.

The overall narrowing market space forces domestic HCFCs distributors to

consider their future operation, and product change in particular, should be taken

into account first.

This is majorly because that new market vane in the refrigeration & air

conditioner industry has been set after FECO released the First Catalogue of

Recommended Substitutes for HCFCs (Exposure draft), which reflected the Chinese

government’s determination to continuously promote the use of natural

refrigerant universally.

The recommended catalogue includes only 1 fluorine-enriched refrigerant,

difluoromethane (HFC-32), and the rest are all natural refrigerant such as

propane (R290), isobutane (R600a), carbon dioxide (CO2), ammonia (NH3) and

cyclopentane.

Substitution work of HCFCs in China

|

Stage

|

Year

|

Objective

|

|

I

|

2013–2015

|

-10% based on frozen level

|

|

II

|

2016–2020

|

-35% based on frozen level

|

|

III

|

2021–2025

|

-67.5% based on frozen level

|

|

IV

|

2026–2030

|

-97.5% based on frozen level and the rest

2.5% for maintenance service

|

Note:

HCFCs stand for hydrochloroflurocarbons;

Frozen level is the average

production and consumption in 2009-2010

Source: Foreign Economic Cooperation Office, Ministry of Environmental

Protection & CCM

According to CCM’s communication with

industry insiders, domestic HCFCs distributors, faced with product change, will

choose hydrofluorocarbons (HFCs) preferentially. However, it is a general trend

that natural refrigerants will be increasingly applied in the future. For

instance, R290 air conditioner has been launched officially in domestic market

in April 2015 and applied gradually in government organisations, colleges and

universities, as the Chinese government is constantly promoting it.

This also shows that natural refrigerant has begun to share the market space

HCFCs emptied out. From a different perspective, the future market space of

HFCs is being occupied, which is vital to the its market participants as the

HFCs industry is currently depressed by excess production capacity and its

recovery depends on growing demand.

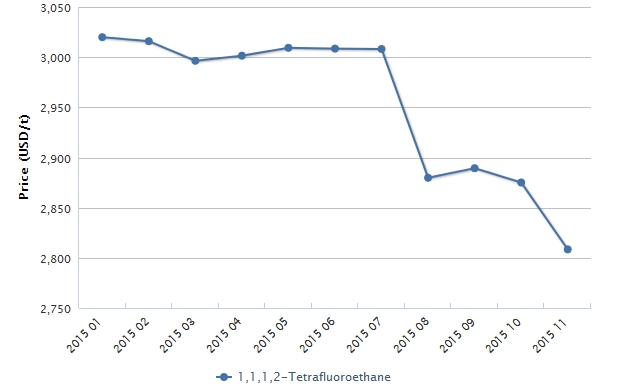

For example, the domestic total capacity of 1,1,1,2-tetrafluoroethane (HFC-134a),

a representative in HFCs industry, is about 220,000 t/a whereas the average

operating rate is 50% in 2015. Compared to the peak period in 2010-2012, the

average operating rate dropped by nearly 30 percentage points and the average ex-works

price even plunged by about 300%, according to the CCM's statistics.

Ex-works price of 1,1,1,2-tetrafluoroethane

in China, January–November 2015

Source: CCM

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc. More about CCM, please visit www.cnchemicals.com.

China Refrigeration is one of the leading exhibitions in the world for refrigeration, air-conditioning, heating and ventilation, frozen food processing, packaging and storage. It will take place on 3 days from Thursday, 07. April to Saturday, 09. April 2016 in Beijing.

We will attend China Refrigeration Beijing in the coming month. If you would like to meet us for consultancy in China Refrigeration Beijing, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.